Finance Division Workflow

The Finance Division of Santiago Water District is responsible in Financial Reporting and Interpretation and Cash Management. Its major functions involve managing receipt and deposit of all monies of SANWAD and accounting and record keeping of financial transactions necessary for the preparation and fair presentation of financial statements for use of internal as well as external decision-makers in compliance with the following:

- Generally Accepted Accounting Principles;

- International Accounting Standards;

- Philippine Financial Reporting Standards;

- International Financial Reporting Standards;

- New Government Accounting System; and

-

Various pronouncements issued by other government agencies such as Commission on Audit (COA), Department of Budget and Management (DBM), Bureau of Internal Revenue (BIR), Civil Service Commission (CSC) and Local Water Utilities Administration (LWUA).

The Finance Division Manual of SANWAD is based from the Commercial Practices Manual for Water Districts and Government Accounting Manual (GAM) For National Government Agencies.

As expected from public servants, the Finance Division personnel of SANWAD are delegated to maintain the highest standards of ethical conduct namely:

1. COMPETENCE

-

Maintain an appropriate level of professional competence by continuous development of their knowledge and skills.

-

Perform their professional duties in accordance with relevant laws, regulations and technical standards.

-

Prepare complete and clear reports and recommendations after appropriate analysis of relevant and reliable information.

- CONFIDENTIALITY

-

Refrain from disclosing confidential information acquired in the course of their work, except when authorized and unless legally obligated to do so.

-

Inform subordinates about the appropriateness of information confidentiality acquired in the course of their work and monitor their activities to assure the maintenance of that confidentiality.

-

Refrain from using or appearing to use confidential information acquired in the course of their work for unethical or illegal advantage either personal or through third parties.

Relative to this, guidelines in the disposition of requests for documents/ records/reports/decisions and other information in the possession and/or custody of COA, including furnishing of copies thereof to requesting parties shall be subject to the provisions of COA Circular No. 2013-006 dated September 18, 2013. To give an emphasis, Section 3.1 of the said COA circular provides that:

“Access to Documents/Records/Reports/Decisions or Other Information. – All documents/records/reports/decisions or other information in the custody or possession of this Commission or its officials or employees by reason of their official functions shall be accessible and available to every person in the manner provided herein during reasonable hours of working days and within the view of the custodian officer, subject to the limitations as herein provided.” underscore supplied.

Thus, the rule on confidentiality observed by the Finance Division personnel of SANWAD does not prohibit, in any manner, the transparency of public documents owed to the public. Nevertheless, it is subject to existing guidelines as mentioned above.

3. INTEGRITY

- Avoid actual or apparent conflicts of interest and advice all appropriate parties of any potential conflict.

- Refrain from engaging in any activity that would prejudice their ability to carry out their duties ethically.

- Refuse any gift, favor or hospitality that would influence or appear to influence their actions.

- Refrain from either actively or passively subverting the attainment of SANWAD legitimate and ethical objectives.

- Recognize and communicate professional limitations or other constraints that would preclude responsible judgment or successful performance of an activity.

- Communicate unfavorable as well as favorable information and professional judgments and opinions.

- Refrain from engaging in or supporting any activity that would discredit the profession.

4. OBJECTIVITY

- Communicate information fairly and objectively.

- Disclose fully all relevant information that could reasonably be expected to influence an intended user’s understanding of the reports, comments and recommendations presented.

5. FUNDAMENTAL PRINCIPLES FOR DISBURSEMENT OF PUBLIC FUNDS

Chapter 2, Section 5 of the GAM also requires, not only the Finance Division of SANWAD, but the whole SANWAD family to strictly adhere to the provisions of Section 4 of P.D. No. 1445, the Government Auditing Code of the Philippines, which provides that all financial transactions and operations of any government entity shall be governed by the following fundamental principles:

-

No money shall be paid out of SANWAD funds and deposits except in pursuance of an appropriation law or other specific statutory authority.

-

SANWAD funds or property shall be spent or used solely for operating and public purposes.

-

SANWAD trust funds shall be available and may be spent only for the specific purpose for which the funds were created or the funds received.

-

Fiscal responsibility shall, to the greatest extent, be shared by all those exercising authority over the financial affairs, transactions and operations of SANWAD.

-

Disbursement or disposition of SANWAD funds or property shall invariably bear the approval of the proper officials.

-

Claims against SANWAD funds shall be supported with complete documentation.

-

All laws and regulations applicable to financial transactions shall be faithfully adhered to.

-

Generally accepted principles and practices of accounting as well as of sound management and fiscal administration shall be observed, provided that they do not contravene existing laws and regulations.

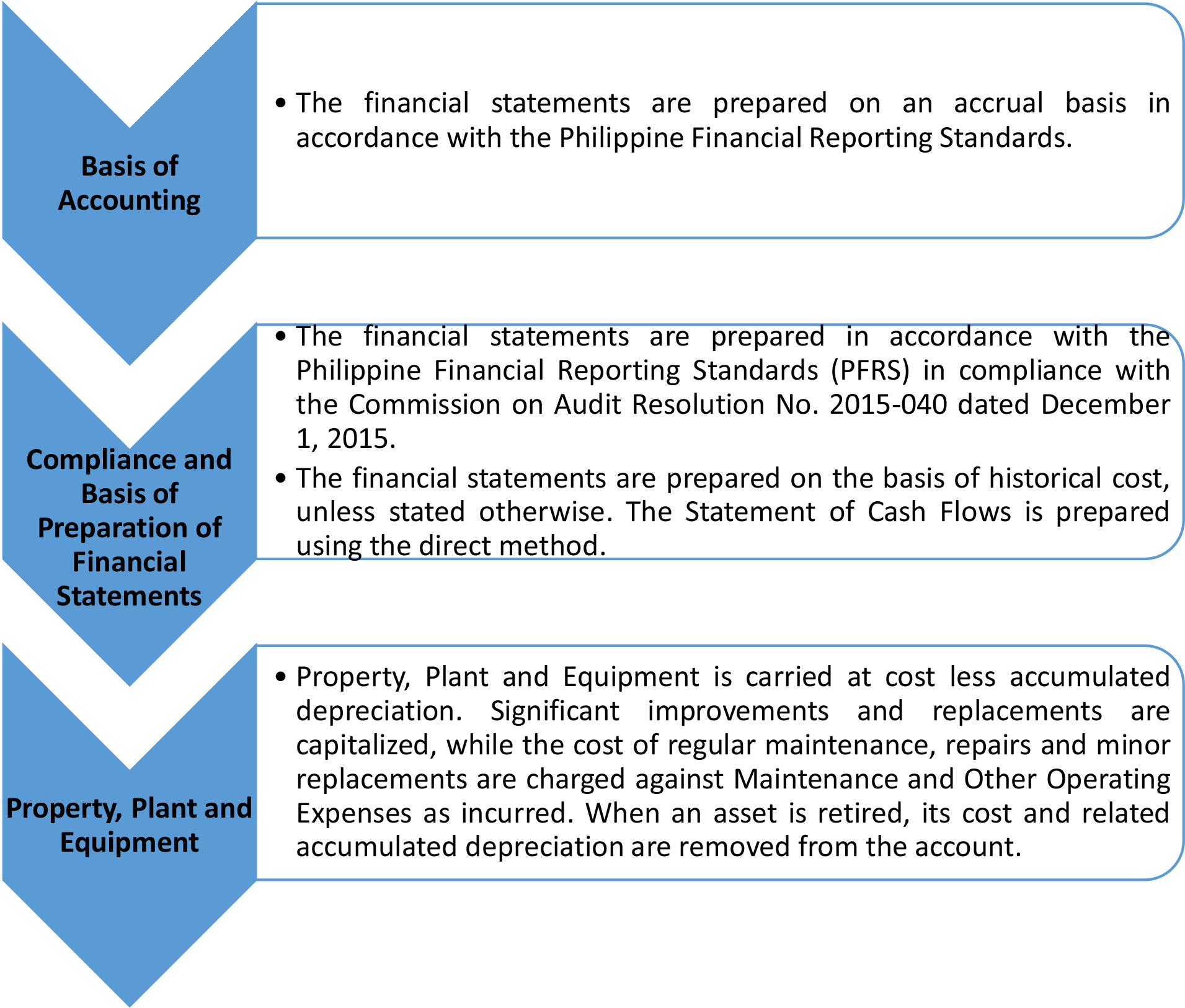

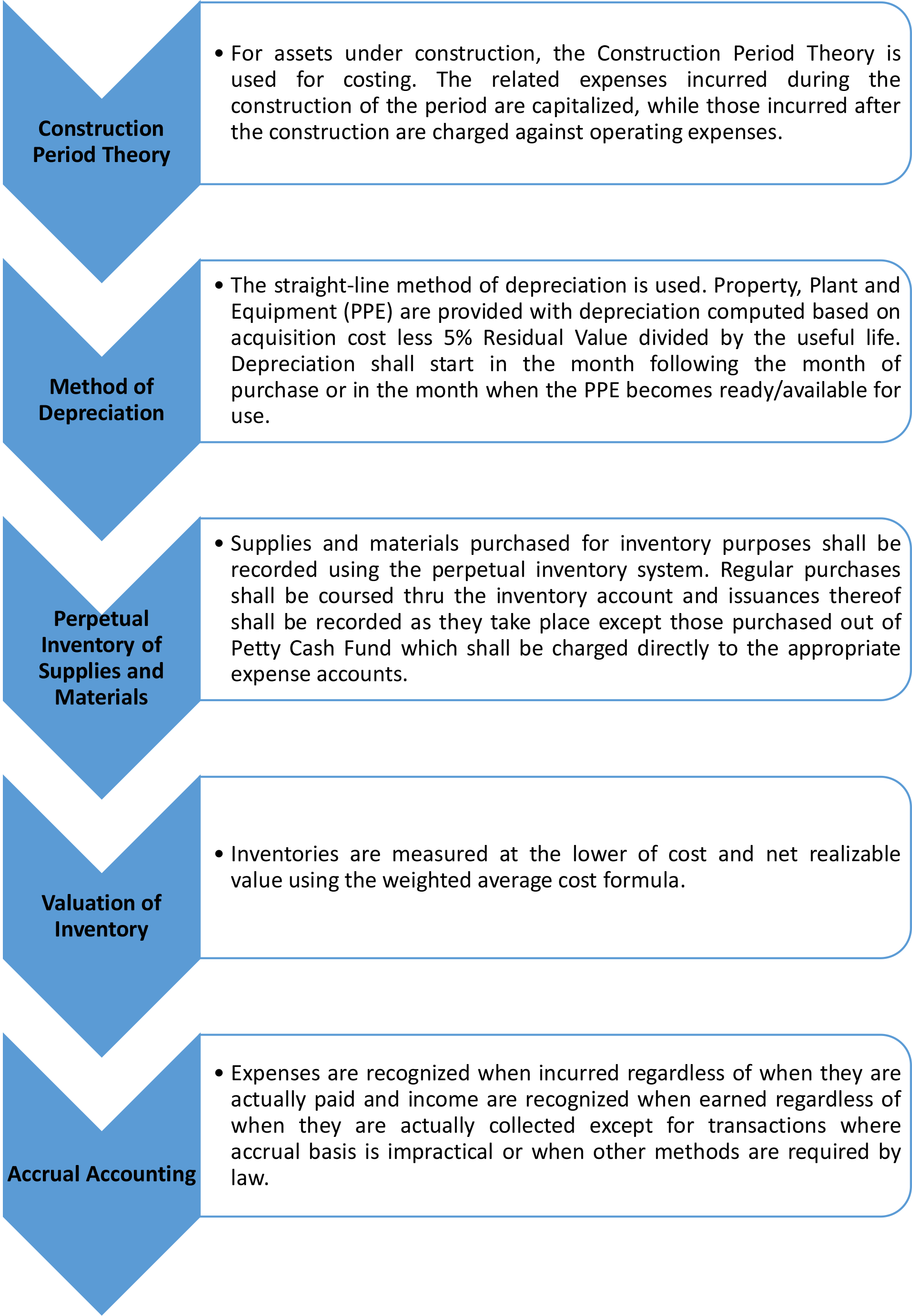

SIGNIFICANT FEATURES AND POLICIES

The Accounting and Cash Management System of Finance Division has the following significant features and policies:

The Finance Division Manual sets the basic standards in accounting as prescribed by the COA to wit:

-

Accounting books, registries, records, forms, reports and financial statements;

-

Coding structure and chart of accounts (Revised Chart of Accounts for Government Corporations as per COA Circular No. 2015-010 dated December 1, 2015); and

-

Uniform guidelines and procedures in accounting for SANWAD funds and property.

ACCOUNTING SYSTEM

The Accounting System of SANWAD covers the source documents, the flow of transactions and its accumulation in the books of accounts and finally their conversion into financial information/data presented in the financial reports. The Accounting System includes:

- Budgetary Accounts System;

- Income/Collections and Deposits System;

- Disbursement System; and

- Financial Reporting System.

BUDGETARY ACCOUNTS SYSTEM

Accounting for Obligation

Obligation refers to a commitment by SANWAD arising from an act of a duly authorized official which binds the SANWAD to the immediate or eventual payment of a sum of money. SANWAD is authorized to incur obligations only in the performance of activities which are in pursuits of its functions and programs authorized in appropriation acts/laws within the limit of the Corporate Operating Budget (COB).

The Division Manager of Finance shall certify the availability of allotment and such is duly obligated by signing in the appropriate box of the Obligation Request (ObR). The Division Manager of Requesting Office shall certify the necessity and lawfulness of appropriation/allotment as well as the validity, appropriateness and legality of supporting documents.

The Budgetary Process shall be discussed in the later part of this Manual.

INCOME/COLLECTIONS AND DEPOSITS SYSTEM

The Receipts/Income Collections and Deposits System covers the processes of acknowledging and reporting income/collections, deposits of collections with the Land Bank of the Philippines (LBP) and Development Bank of the Philippines (DBP) and recording of collections and deposits in the books of accounts of SANWAD.

The income of SANWAD are classified into general income accounts to wit:

- Other Business Income;

- Metered Sales to General Customers;

- Unmetered Sales to General Customers;

- Interest Income;

- Other Waterworks System Fees;

- Other Service Income – Meter Rental;

- Other Service Income – Service Line Maintenance Fee;

- Fines and Penalties – Service Income;

- Fines and Penalties – Business Income;

- Rent/Lease Income;

- Sale of Unserviceable Property; and

- Miscellaneous Income.

SANWAD adopts the following accounting methods of recording income:

-

Accrual Method – Accrual method of accounting shall be used by SANWAD when income is realized (earned) during the accounting period regardless of cash receipt. Accounts receivable is set up and the general accounts according to nature and classification are credited.

-

Cash Basis – Cash basis of accounting shall be used for all other taxes, fees, charges and other revenues where accrual method is impractical. The income account is credited upon collection of the cash or its equivalent.

The Supervising Cashier shall deposit all collections turned-over to her by the Office Bill Collectors/Tellers with the LBP and DBP daily or not later than the next banking day. The Supervising Cashier shall record all deposits made in the Daily Cash Receipts and Deposits Record.

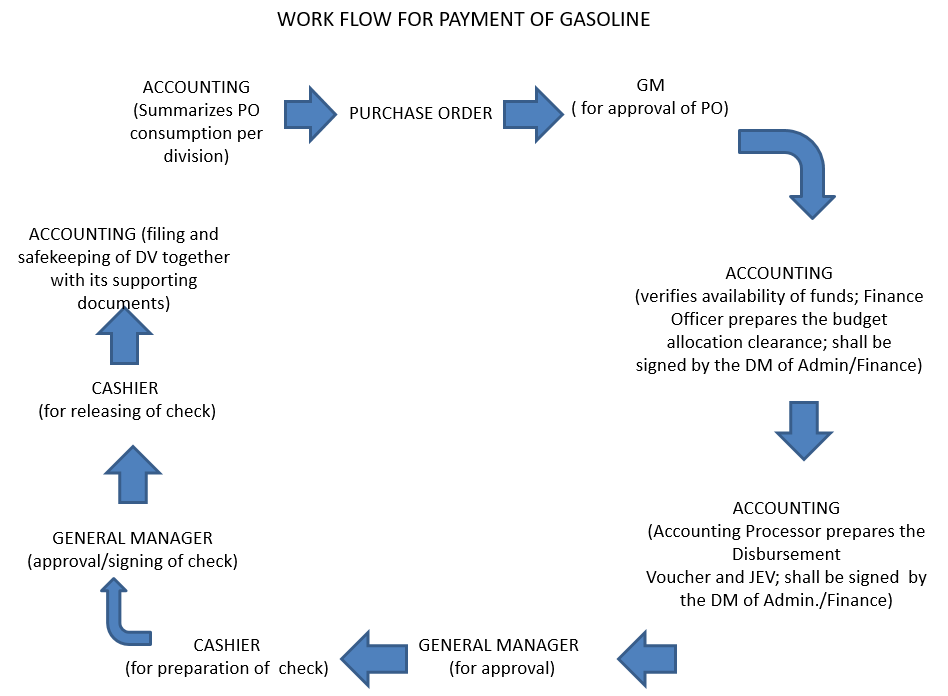

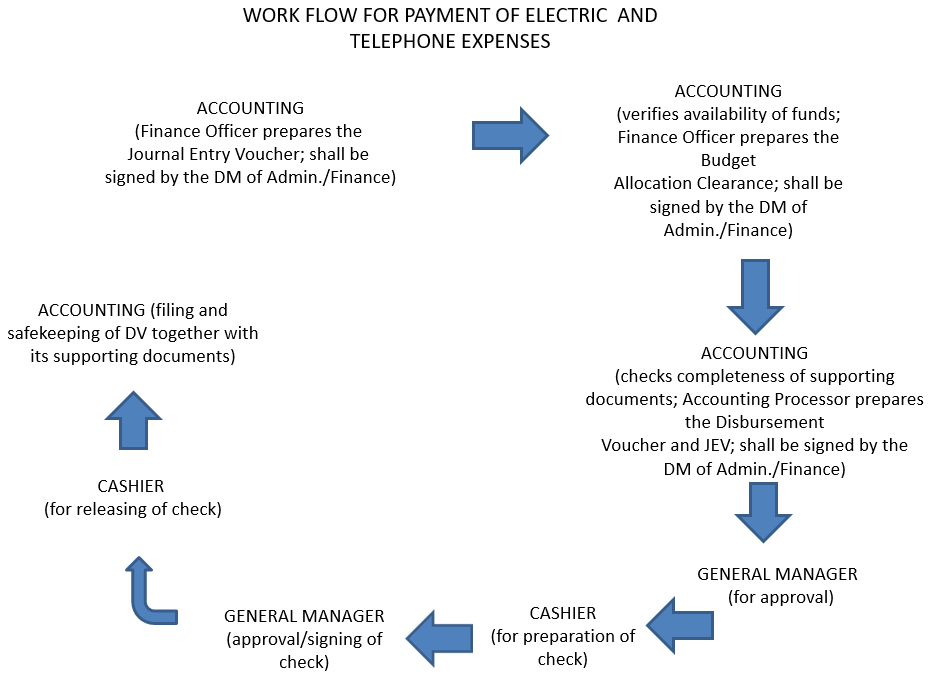

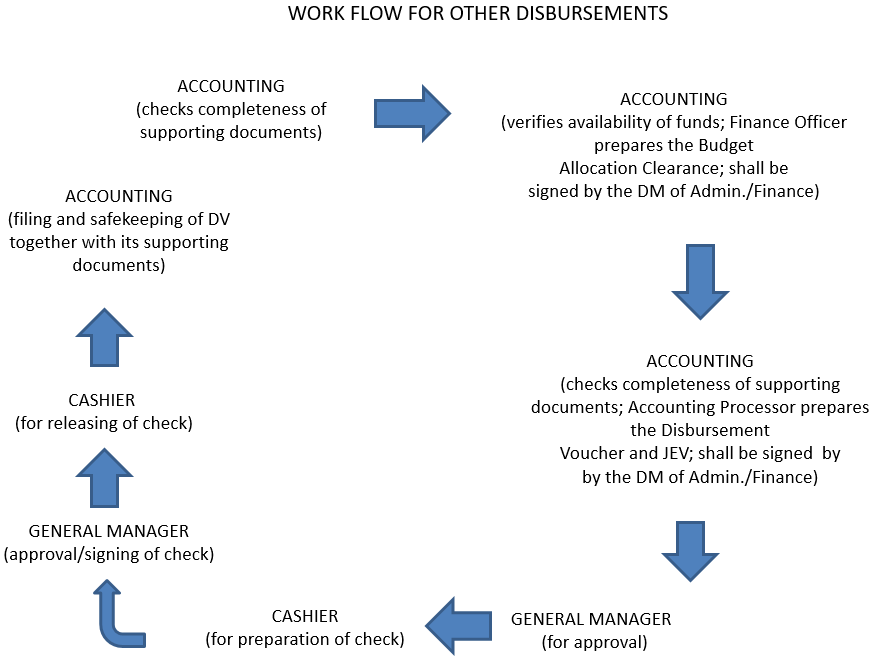

DISBURSEMENTS SYSTEM

Disbursement is the settlement of government payables/obligations by government checks. In no case shall disbursement be made by cash except when thru Petty Cash Fund and Payroll. It shall be covered by Disbursement Voucher (DV)/Petty Cash Voucher (PCV) or payroll.

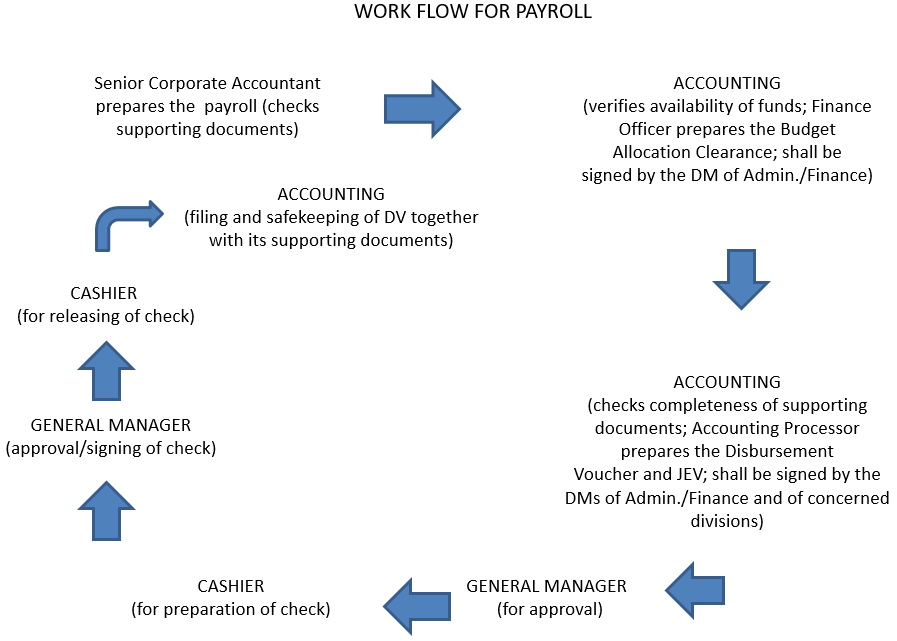

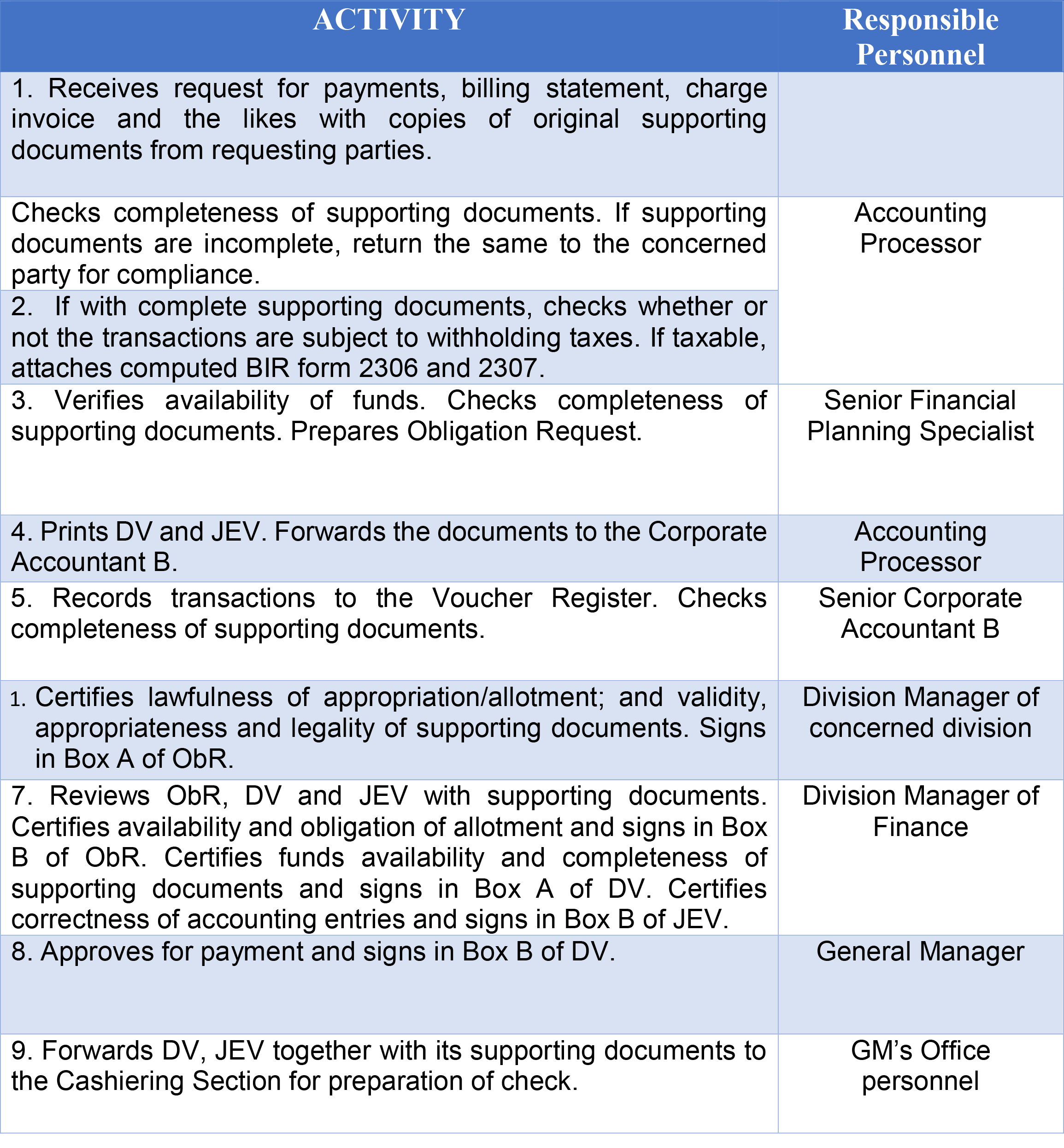

The Disbursements System involves the preparation and processing of disbursement voucher (DV) and preparation and issuance of check (Cashiering Section). All Disbursement Vouchers shall be recorded in the Voucher Register.

In compliance with the basic requirements applicable to all types of disbursements from government funds, the Finance Division of SANWAD shall strictly observe the following conditions:

-

Existence of a lawful and sufficient appropriation duly certified by the authorized officer;

-

Existence of a valid obligation duly certified by the authorized officer;

-

Legality of transactions and conformity with laws, rules and regulation;

-

Approval of the expense by the General Manager; and

-

Submission of proper evidence to establish the claim.

Checks shall be drawn only on duly approved DV.

Disbursements by cash shall be made from cash advances drawn and maintained in accordance with COA rules and regulations. Cash payments shall be made based on duly approved payrolls/disbursements vouchers.

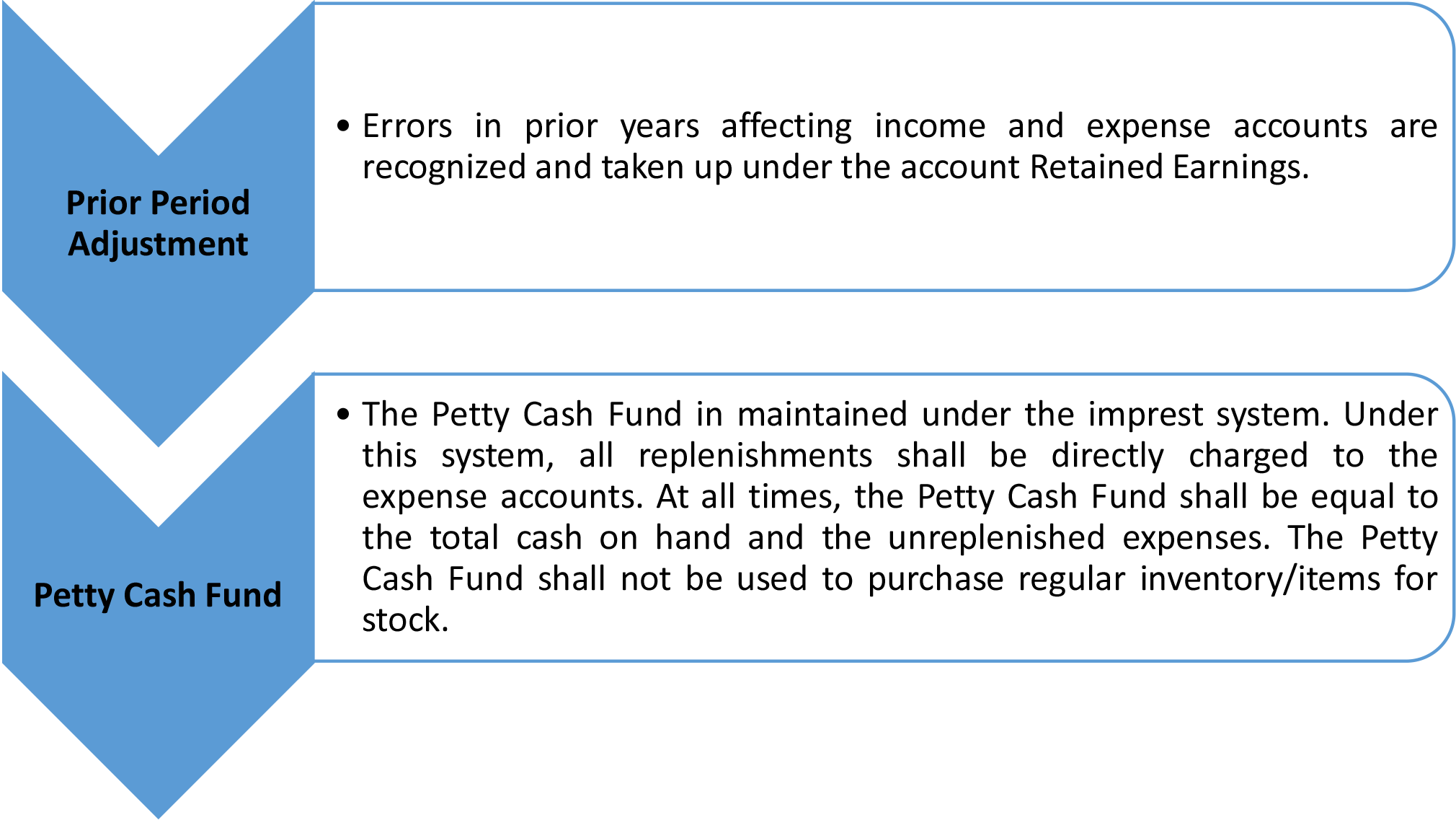

Petty Cash Fund shall be maintained under the Imprest Fund System. The fund shall be sufficient for the nonrecurring, emergency and petty expenses of the SANWAD. Disbursements from the fund shall be through the Petty Cash Voucher (PCV) which shall be approved by authorized officials and signed by the payee to acknowledge the amount received. The official receipt or its equivalent is attached to the PCV.

Below is the detailed procedures for disbursements, in general:

FINANCIAL REPORTING SYSTEM

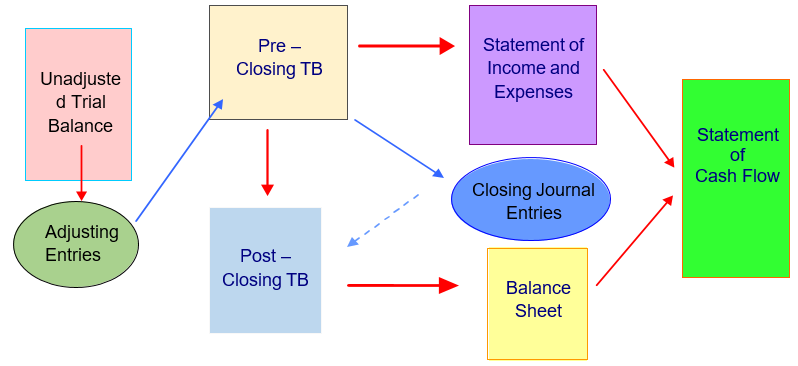

The Financial Statement Process

Financial Reporting System (FRS) includes the preparation and submission of trial balances, financial statements and other reports needed by fiscal and regulatory agencies specifically the COA and LWUA. The FRS consists of the following:

- Preparation and Submission of Trial Balances and Other Reports

- Preparation and Submission of Financial Statements

Below is the detailed procedures in the preparation of financial reports:

SENIOR FINANCIAL PLANNING SPECIALIST

MONTHLY FINANCIAL REPORTS

- Extends figures from the Statement of Financial Performance and Statement of Financial Position columns. Ensure the proper extension of account balances to their corresponding statement columns.

- Prepares the Cash Flow Statement using the following:

- Cash Receipts Register

- Voucher Register

- Cash Flow Statement of last Month

- Reconcile ending balance in the Cash Position Report of the last day of the month with the cash in the bank figures in the Balance Sheet.

- Prepares Monthly Data Sheet.

Note: Basic financial reports and Monthly Data Sheet are prepared monthly. Copies of which are submitted to the Board of Directors and LWUA.

YEARLY FINANCIAL REPORTS

- Prepares the statement of changes in equity using the following:

- Last year’s Statement of Changes in Equity

- Current year’s Statement of Financial Position

- Current year’s Statement of Financial Performance

-

Analyze increases/decreases and prepares narrative report, if necessary, distribute copies.

Generation of Financial Statements and Supporting Schedules. Financial statements and their supporting schedules are the products of the SANWAD accounting processes. These are the principal comprehensive means by which the information accumulated and processed in the state accounting system is periodically communicated to those who use them. The financial statements generally prepared in SANWAD are: the Statement of Financial Position, Statement of Financial Performance, Statement of Cash Flows, and Statement of Changes in Equity.

Responsibility for Financial Statements. Responsibility for the fair presentation and reliability of financial statements rests with the management of SANWAD particularly the Division Manager of Finance and the General Manager. This responsibility is discharged by applying generally accepted state accounting principles that are appropriate to the entity’s circumstances, by maintaining effective system of internal control and by adhering to the chart of accounts prescribed by the Commission on Audit.

To achieve fair presentation and reliable information of the financial statements, the following standards shall be observed.

-

Fairness of presentation. This refers to the overall propriety in disclosing financial information. Full disclosure in financial aspects requires observance of the following standards of reporting:

-

All essential facts relating to the scope and purpose of each report and the period involved shall be included and clearly displayed.

-

All financial data presented shall be accurate, reliable, and truthful. The requirement for accuracy does not rule out the inclusion of reasonable estimates when the making of precise measurements is impracticable, uneconomical, unnecessary, or conducive to delay. All appropriate steps shall be taken to avoid bias, unclear facts, and presentation of misleading information.

-

Financial reports shall be based on official records maintained under an adequate accounting system that produces information objectively and discloses the financial aspects of all events or transactions taking place. Where financial data or reports based on sources other than the accounting systems are presented, their basis shall be clearly explained.

-

The financial data reported shall be derived from accounts that are maintained in all material respects on a consistent basis from period to period; material changes in accounting policies or methods and their effect shall be clearly explained.

-

Consistent and non-technical terminology shall be used in financial reports to promote clarity and usefulness.

2. Compliance. The report shall be in accordance with prescribed government requirements and international accounting standards of reporting.

3. Timeliness. All needed reports shall be produced promptly to be of maximum usefulness.

4. Usefulness. Financial reports shall be carefully designed to present information that is needed and useful to reports users.

Statement of Management Responsibility for Financial Statements. The Statement of Management Responsibility for Financial Statements shall serve as the covering letter in transmitting SANWAD financial statements to the Commission on Audit. It is the declaration of SANWAD’s Management of taking responsibility for designing and implementing internal controls relevant to the preparation and fair presentation of financial statements that are free from material misstatement whether due to fraud or error, selecting and applying appropriate accounting policies and making accounting estimates that are reasonable in the circumstances. The Division Manager of Administrative/Finance and the General Manager sign the statement. The Chairperson of the Board of Directors also signs the statement after review and approval by the Board of Directors of the financial statements. The approval by the Board of Directors authorizes the issuance of the financial statements to the regulators, creditors and other users.

Balance Sheet. The Balance Sheet is a formal statement which shows the financial condition of SANWAD as of a certain date. It includes information on the three elements of financial position – assets, liabilities and government equity. It shall be prepared from information taken directly from the year-end Post-Closing Trial Balance. The Balance Sheet shall be supported with the following schedules/statements:

- Schedules of Accounts Receivables

- Schedules of Accounts Payables

- Other schedules as may be required

Statement of Income and Expenses. The Statement of Income and Expenses shows the results of operation/performance of SANWAD at the end of a particular period. This statement shall be prepared by the Accounting Unit from information taken directly from the Pre-Closing Trial Balance.

Statement of Government Equity. The Statement of Government Equity shows the financial transactions, which resulted to the change in Government Equity account at the end of the year.

Statement of Cash Flows. The Statement of Cash Flows is a statement summarizing all the cash activities of SANWAD. This includes the operating, investing and financing activities of the entity and provides information on the cash receipts and cash payments during the period. The primary purpose of the Statement of Cash Flows is to give relevant information on the SANWAD overall cash position, liquidity and solvency. Using the Statement of Cash Flows, managers, investors and creditors could easily assess if SANWAD could meet its obligations in operating, investing and financing activities.

Relative to Cash Flows is the preparation of monthly bank reconciliation. Bank reconciliation statement is a very important tool for internal control of cash flows. It helps in detecting errors, frauds and irregularities occurred, if any, whether intentionally or unintentionally. It works as an important mechanism of internal control. The following are the salient features of bank reconciliation statement:

-

The reconciliation will bring out any errors that may have been committed either in the cash book or in the pass book;

-

Any undue delay in the clearance of checks will be shown up by the reconciliation; and

- It helps in finding out the actual position of the bank balance.

DETAIL PROCEDURES IN BANK RECONCILIATION

SENIOR FINANCIAL PLANNING SPECIALIST

-

Receives monthly bank statement, and debit and credit memoranda.

-

Compares the check charges in the bank statement against the paid checks in the Voucher Register in order to identify outstanding checks.

-

Checks the accuracy of the debits and credits in the debit/credit memoranda and compares them with those recorded in the bank statement.

-

Compares per bank account the beginning balance in the bank statement with the ending balance in the previous month’s bank reconciliation statement to determine its correctness.

-

Compares per bank account the ending balance in the bank statement with the General Ledger balance. At the same time, checks deposits and disbursements made by referring to the Cash Receipts Register and Voucher Register.

-

Prepares Bank Reconciliation Statement to reconcile ending balances of bank statement and General Ledger cash account. Correctness of the Bank Reconciliation Statement shall be certified by the Division Manager of Administrative/Finance.

-

Prepares Journal Vouchers for the bank debit/credit memoranda from the Supervising Cashier not previously recorded in the General Ledger and other reconciling items per book. Correctness of the Journal Vouchers shall also be certified by the Division Manager of Administrative/Finance.

-

For any bank error, the Supervising Cashier prepares in two copies the Letter to Bank Citing Differences.

-

Forwards the following documents to the General Manager for his/her review and approval:

- Letter to Bank Citing Differences (to be prepared by the Supervising Cashier) – original and duplicate

- Journal Voucher – original and duplicate

- Bank Reconciliation

- Bank Statement

- Debit/Credit Memoranda

- Other supporting documents

- Receives from the General Manager the following documents:

- Letter to Bank Citing Differences (prepared by the Supervising Cashier) – original and duplicate

- Journal Voucher – original and duplicate

- Bank Reconciliation

- Bank Statement

- Debit/Credit Memorandums

- Other supporting documents

-

Forwards to the bank the original copy of the Letter to bank Citing Differences, if there is any.

-

Forwards to Cashier the original copy of the Journal Voucher and the Debit/Credit Memoranda. This will be done only in case when the adjustments involve changes in cash balance such as bank charges, disbursements through bank debits, and other similar transactions.

-

Files the duplicate copy of the Journal Voucher. Files separately the Bank Reconciliation Statement together with the duplicate copy of the letter to Bank Citing Differences and Statement together with the paid checks.

-

Receives from the Cashier the original copy of the Journal Voucher and the Debit/Credit Memoranda.

-

Posts cash account adjustments in the General Ledger and the related Bank Subsidiary Ledger.

-

Files the Journal Voucher in one file and the Debit/Credit Memoranda with the Bank Statement.

GENERAL MANAGER

- Receives the documents from the Bookkeeper.

- Reviews the Bank Reconciliation.

- Reviews letter to bank citing differences and signs.

- Approves the Journal Voucher for unrecorded bank Debit/Credit Memoranda.

- Returns documents to the Finance Division for filing, recording and mailing.

DIVISION MANAGER, FINANCE

- Certifies correctness of the Bank Reconciliation Statement.

- Certifies correctness of the Journal Vouchers.

CASHIER

- Forwards to the Senior Financial Planning Specialist copy of Debit/credit Memorandums.

- Prepares Letter to Bank Citing Differences.

- Receives from the Senior Financial Planning Specialist copy of the Journal Voucher.

Post adjusting entry in the cashbook and returns the documents to the Book keeper.

WORK FLOW FOR BANK RECONCILIATION

Notes to Financial Statements. Notes to Financial Statements are integral parts of financial statements, which pertain to additional information necessary for fair presentation in conformity with generally accepted accounting principles. These may explain the headings captions or amounts in the statements of present information that cannot be expressed in money terms, and description of accounting policies.

Information shall be presented in a way that will facilitate understanding and avoid erroneous implications. The headings, captions and amounts shall be supplemented by enough additional data so that their meaning would be clear and not overshadowed by so much information that important matters are buried in mass trivia.

Material changes in classification of accounts shall be indicated and explained as notes to financial statements.

THE BUDGETARY PROCESS

The present SANWAD’s DBM-approved Plantilla of Positions does not provide for Budgeting Division/Section that shall facilitate the budgeting system. In order to maximize SANWAD’s available manpower, the budgeting function is delegated to its Finance Division.

Government budgeting is the critical exercise of allocating revenues and borrowed funds to attain the economic and social goals of the country. It also entails the management of government expenditures in such a way that will create the most economic impact from the production and delivery of goods and services while supporting a healthy fiscal position. Government budgeting is important because it enables the government to plan and manage its financial resources to support the implementation of various programs and projects that best promote the development of the country. Through the budget, the government can prioritize and put into action its plants, programs and policies within the constraints of its financial capability as dictated by economic conditions (https://www.dbm.gov.ph/wp-content/uploads/2012/03/PGB-B2.pdf).

SANWAD creates its Corporate Operating Budget based on the following:

- Projected Income/Revenues;

- Unrestricted Cash Balance of the Prior Year; and

- Other budget assumptions such as number of new service connections, collection efficiency, etc.

Basic Concepts of Budgeting

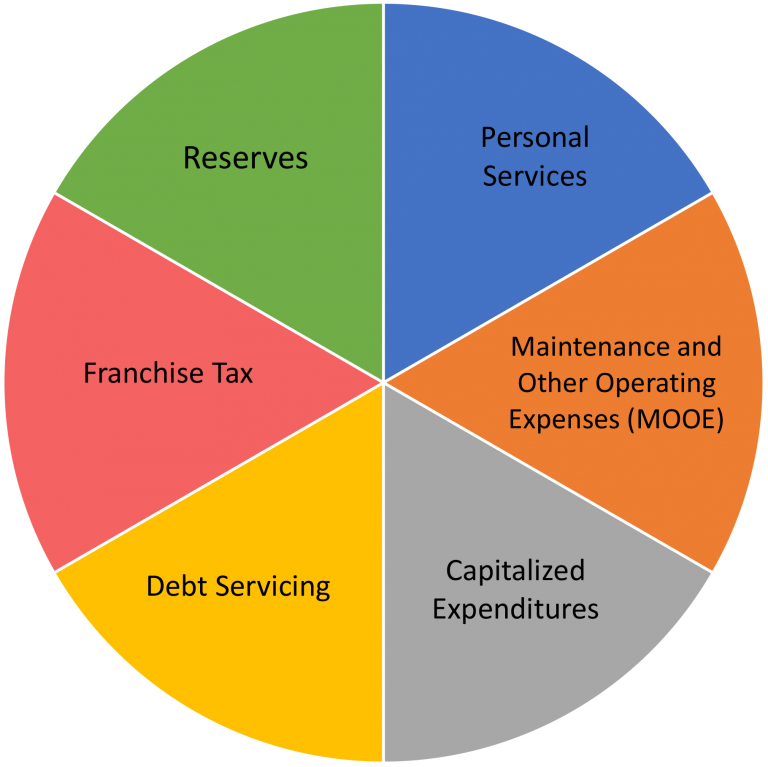

The Santiago Water District prepares its Corporate Operating Budget consisting of the following:

- Projected Statement of Financial Performance; and

- Projected Statement of Cash Flows.

The projected Statement of Financial Performance includes estimates on income and estimates on expenses. The projected Statement of Cash Flows covers collections and disbursements which include Personal Services, Maintenance and Other Operating Expenses as well as Capital Expenditures and debt servicing. Future borrowings are also considered.

Expenditures

Projected Income – an estimate of the financial results from projected revenue against Maintenance & Other Operating Expenses (MOOE) & loan interest in a future period of time. It is often presented in the form of an income statement.

Unrestricted Cash – Monetary reserves that are not tied to a particular use. Unrestricted cash represents instant reserves, as it can be used for any purpose and is extremely liquid. Often, in order to satisfy debt covenants, firms will have to maintain a certain level of cash on their balance sheets.

Personal Services – Provisions for the payment of salaries, wages and other compensation (e.g., merit, salary increase, cost-of-living-allowances, honoraria and commutable allowances) of permanent, temporary, contractual, and casual employees of the government.

Maintenance and Other Operating Expenses – Refer to expenditures to support the operations of SANWAD such as expenses for supplies and materials; transportation and travel; utilities (water, power, etc.) and the repairs, etc.

Capitalized Expenditures

Capital Outlay – Refer to appropriations for the purchase of goods and services, the benefits of which extend beyond the fiscal year and which add to the assets of the SANWAD.

Property Plant & Equipment – are tangible assets of SANWAD used in the daily operation of the district for the supply of sufficient potable water to its concessionaires.

Debt Servicing – refers to appropriations in payment of SANWAD loans from LWUA and other financing institutions.

Reserves – are savings account of SANWAD which is accumulated for future use. This fund is sourced from surplus from operation of scheduled Fund Transfers that have been planned and budgeted intended for debt service and operating and maintenance, to be used for such purposes only during periods of calamities, force majeure or unforeseen events.

Ideally, the proposed Corporate Operating Budget (COB) of SANWAD must be prepared, during the last quarter of the current year and be approved by the Board of Directors before October 31 of the same current year prior to implementation.

The COB of the SANWAD is also accompanied by a separate schedule of projected Comparative Statement of Income and Expenses, projected Billing, proposed Capital Expenditures, and such other financial projections as may be required, together with the underlying assumptions adopted in making the projections.

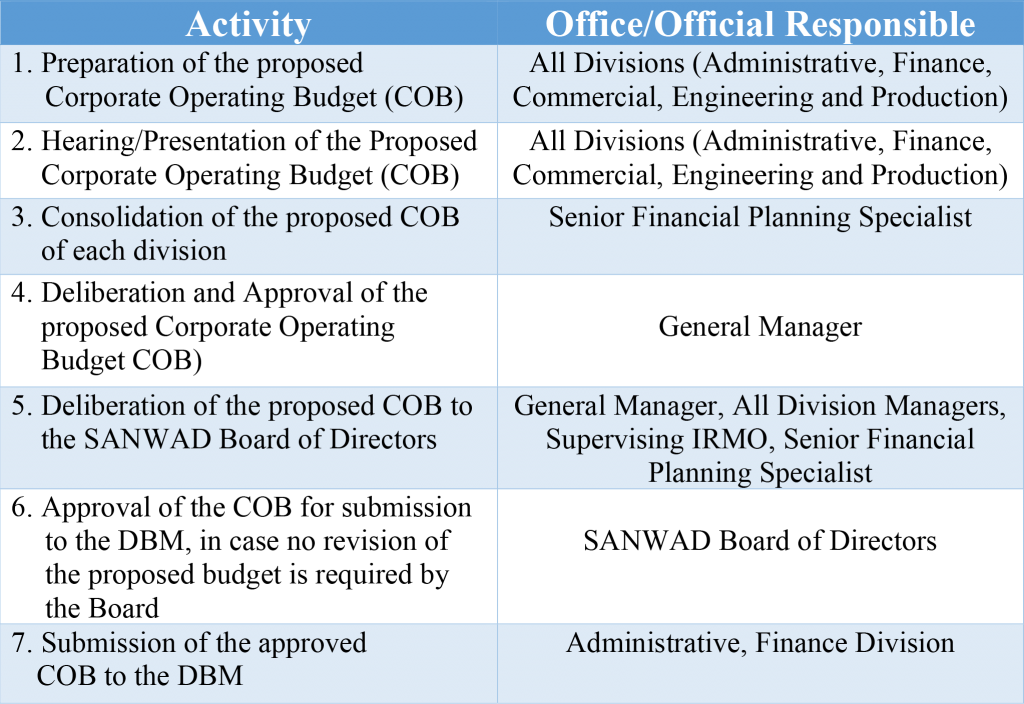

Budget Preparation Process

The following are the general procedures for the budget preparation:

Basic Features of Budgeting

General

-

At the end of the third quarter, next year’s budget is prepared upon instruction of the General Manager to the Division Managers.

-

The Senior Financial Planning Specialist consolidates the proposed budget prepared by all divisions.

-

The General Manager reviews and discusses the consolidated budget with the Division Managers, Senior Financial Planning Specialist and Supervising Industrial/Management Officer.

-

The General Manager, together with the Division Managers, Senior Financial Planning Specialist and Supervising Industrial/Management Officer, presents the SANWAD’s total proposed budget to the Board of Directors for approval.

Preparation of Operating Revenues Budget and Other Income Budget

-

The Division Manager of Commercial Division, prepares the Operating Revenues Budget from the Estimated Water Sales and Other Income Budget from revenues other water sales.

Projected collections are then computed based on this estimate using the projected collection efficiency rate.

-

The General Manager gives his approval on these revenue estimates after thorough discussion with the other Division Managers and key personnel.

Preparation of Division Expense Budgets

-

Each Division Manager prepares an estimate of operation and maintenance expenses based on historical data and projected levels of operations and prices. Each expense item is presented in a Project Procurement Management Plan (PPMP).

- The General Manager gives the final approval on the Division Expense Budgets.

Preparation of Division Capital Expenditures Budgets

-

Each Division Manager is responsible for the preparation of his/her division’s Capital Expenditures Budget.

-

The General Manager gives the final approval on the divisions Capital Expenditures Budgets.

Initially, budgets are prepared on annual basis. However, as the Water District gains experience and accumulates more reliable actual data, monthly budgets should be prepared for more accuracy. The “Actual Current Years” figure to be compared against the budgeted amount will consist of actual data for the first nine months plus the budgeted figure for the last three months of the current year.

Preparation of Consolidated Budget

-

The General Manager receives from the Division Manager and reviews the following budgets:

- Operating Revenue Budget

- Division Expenses Budget

- Division Capital Expenditures Budget

- Materials and Supplies Budget

- Other Income Budget

The general Manager discusses these budgets with the Division Managers to clarify or amplify the information contain therein. He then approves these budgets.

2. Based on these approved division budget and other data, the Senior Financial Planning Specialist prepares the following consolidated budgets:

- Financial Performance Budget

- Cash Budget

-

The General Manager reviews and approves these consolidated budgets. He, together with the Division Managers, Senior Financial Planning Specialist and Supervising Industrial/Management Officer, presents the same to the Board of Directors for approval.

-

After approval by the Board of Directors, the consolidated budgets will be distributed to the Directors, Division Managers, DBM and LWUA.